|

Chapter: Introduction1. Net InvestmentNet Investment = Gross Investment – Depreciation 2. Net Indirect TaxNet Indirect Tax = Indirect Taxes – Subsidies 3. Market PriceMarket Price = Factor Cost + Net Indirect Taxes OR = Factor Cost + (Indirect Taxes – Subsidies) 4. Net factor Income from Abroad (NFIA)Net Factor Income from Abroad = Factor income earned from abroad – Factor income paid abroad OR Net Factor Income from Abroad = Net Compensation of Employees + Net Income from Property and Entrepreneurship + Net Retained Earnings 5. National Income (using NFIA)National Income = Domestic Income + NFIA 6. DepreciationDepreciation = Gross Value – Net Value 7. Leakages in Different Types of Economies

8. Injections in Different Types of Economies

Chapter: National Income Accounting1. National Income and Related Aggregates

GDPFC = GDPMP – Net Indirect Taxes

NDPMP = GDPMP – Depreciation

NDPFC = GDPMP – Net Indirect Taxes – Depreciation

GNPMP = GDPMP + Net Factor Income from Abroad

GNPFC = GNPMP – Net Indirect Taxes

NNPMP = GNPMP – Depreciation

NNPFC = GNPMP – Net Indirect Taxes – Depreciation 2. Domestic IncomeIncome from Domestic Product accruing to Private Sector = NDPFC – Income from Property and Entrepreneurship accruing to Government Administrative Departments – Savings of Non-Departmental Enterprises 3. Private IncomePrivate Income = Factor Income earned (within domestic territory + from rest of the world) + Transfer Income received (within domestic territory + from rest of the world) OR = Income from Domestic Product Accruing to Private Sector + NFIA + Interest on National Debt + Current Transfers from Government + Net Current Transfer from Rest of the World 4. Personal Disposable IncomePersonal Disposable Income = Personal Income – Personal Taxes Miscellaneous Receipts of Government OR = Personal Consumption Expenditure + Personal Savings 5. National Disposable IncomeNational Disposable Income = National Income + Net Indirect Taxes + Net Current Transfers from the rest of the world OR = National Consumption Expenditure + National Savings 6. Gross National Disposable IncomeGross National Disposable Income = Net National Disposable Income + Depreciation 7. Product or Value Added Method of calculating National Income

∑GVAMP = GDPMP

Value Added = Value of Output – Intermediate Consumption

Value of Output = Sales

Value of Output = Sales + Change in Stock

Value of Output = (Quantity × Price) + Change in Stock

National Income or NNPFC = GDPMP – Depreciation – Net Indirect Taxes + NFIA OR = Domestic Income or NDPFC + NFIA 8. Expenditure Method of calculating National Income

GDPMP = ∑ Final Expenditure ∑ Final Expenditure = Private Final Consumption Expenditure (PFCE) + Government Final Consumption Expenditure (GFCE) + Gross Domestic Capital Formation (GDCF) + Net Exports (NX)

PFCE = Household Final Consumption Expenditure + Non-profit Private Institutions Final Consumption Expenditure

GFCE = Intermediate Consumption of Government + COE paid by Government +Direct purchases from abroad for embassies and consulates located abroad – Sale of goods and services produced by general government

GDFC = Gross Fixed Capital formation + Inventory Investment = Gross Business Fixed Investment + Gross Residential Construction Investment + Gross Public Investment + Inventory Investment

Net Exports = Exports – Imports or (X-M)

National Income or NNPFC = ∑Final Expenditure or GDPMP – Depreciation – Indirect taxes + NFIA OR = Domestic Income or NDPFC + NFIA 9. Income Method of calculating National Income

Profit = Corporate Tax + Dividend + Retained Earnings

Operating Surplus = Rent + Royalty + Interest + Profit or = Value of Output – Intermediate Consumption – Compensation of Employees – Mixed Income – Consumption of Fixed Capital – Net Indirect Taxes

NNPFC = NDPFC + NFIA Where, NDPFC = Compensation of Employees + Profit + Rent & Royalty + Interest + Mixed income 10. National Income at Constant Price

11. Nominal GDP or GDP at Current Price

12. Real GDP or GDP at Constant Price

13. GDP Deflator

Chapter: Money and Banking1. Measures of Money Supply

M1 = Currency and coins with public + Demand deposits of commercial banks + Other deposits with Reserve Bank of India

M2 = M1 + Savings Deposits with Post Office Saving Bank

M3 = M1 + Net Time Deposits with Banks

M4 = M3 + Total Deposits with Post Office Saving Bank 2. Money Multiplier

Chapter: Determination of Income and Employment1. Aggregate DemandAggregate Demand (AD) = C + I + G + (X – M) = Private Consumption Expenditure + Investment Expenditure + Government Expenditure + Net Exports (Exports – Imports) 2. Aggregate SupplyAggregate Supply (AS) or National Income (Y) = Consumption (C) + Saving (S) 3. Consumption FunctionC = f(Y) Where, C = Consumption f = Functional Relationship Y = National Income 4. Average Propensity to Consume (APC)

5. Marginal Propensity to Consumer (MPC)

6. Saving FunctionS = f(Y) Where, S = Saving f = Functional Relationship Y = National Income 7. Average Propensity to Save (APS)

8. Marginal Propensity to Save (MPS)

9. Relationship between APC ad APSAPC + APS = 1 10. Relationship between MPC and MPSMPC + MPS = 1 11. Values of APC, APS, MPC, and MPS

12. Equation of Consumption Function

Where, C = Consumption

b = MPC Y = Income 13. Equation of Saving Function

Where, S = Saving

1-b = MPS Y = Income 14. Marginal Efficiency of Investment (MEI)

15. Two Approaches for Determination of Equilibrium Level

AD = AS

S = I 16. Investment Multiplier

OR

OR

The maximum value of the Multiplier is ∞ when MPC = 1 The minimum value of Multiplier is 1 when MPC = 0 Chapter: Government Budget and the Economy1. Measures of Government Deficit

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Fiscal Deficit = Total Expenditure – Total Receipts (except borrowings) OR = (Revenue Expenditure + Capital Expenditure) – (Revenue Receipts + Capital Receipts excluding Borrowings) OR = (Revenue Expenditure – Revenue Receipts) + (Capital Expenditure – Capital Receipts excluding Borrowings) OR = Revenue Deficit + (Capital Expenditure – Capital Receipts excluding Borrowings)

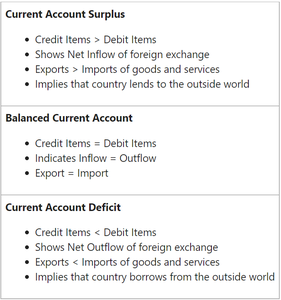

Primary Deficit = Fiscal Deficit – Interest Payment Chapter: Balance of Payments1. Balance of TradeBalance of Trade = Exports of Goods – Imports of Goods 2. Balance on Current Account

3. Balance on Capital Account

|

|||||||||||||||||||||||||||||||||||||||||||||

Reffered: https://www.geeksforgeeks.org

| Macroeconomics |

| Related |

|---|

| |

| |

| |

| |

| |

Type: | Geek |

Category: | Coding |

Sub Category: | Tutorial |

Uploaded by: | Admin |

Views: | 12 |