|

|

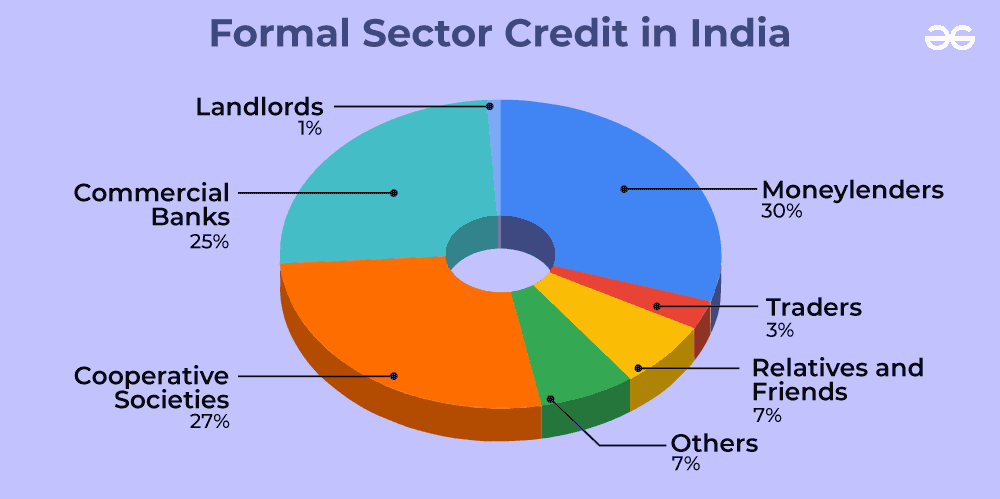

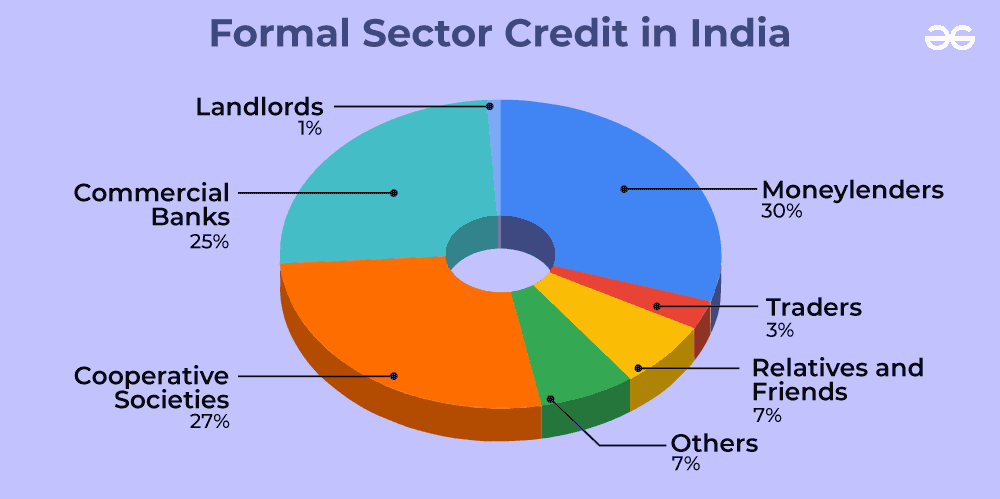

Formal Sector Credit in India: Formal sector credit in India incorporates loans from banks and cooperatives. RBI oversees its elements of giving credits. Rich metropolitan families rely to a great extent upon the formal sector of credit. The Reserve Bank of India manages the working of the formal sector of advances. For example, we have seen that the banks keep the least money balance out of the stores they get. The RBI screens the banks to keep up with the cash balance. Comparably the RBI sees that the banks give credits not simply to benefit-making organizations, what’s more, brokers yet in addition to little cultivators, limited-scope ventures, little borrowers, and so on. Intermittently, banks need to submit data to the RBI on the amount they are loaning, to whom, at what interest rate, and so on.  Formal Sector Credit in India For what reason do we have to grow the formal sector of credit in India?The formal Sector of credit in India should be extended for the improvement of the country. Modest and reasonable credit is needed for the advancement of the country.

Credit in Rural areas and Urban areasAgriculture is the essential type of revenue for people living in the rustic locales across India. Consistently, ranchers and workers need to contribute a lot of assets to guarantee a solid gathering. In this way, they frequently resort to getting cash from moneylenders and monetary foundations to satisfy their essential necessities before gather season shows up, and they can bring in cash by selling their yields. Hence, any advance taken for farming purposes or little self-start ventures across the rustic regions in India is known as a Rural Credit. In urban areas people are taking credit for the purpose of Business, Industrial, etc. The distinction in financial exercises of provincial individuals comparative with metropolitan individuals prompted the acknowledgment of NABARD (National Bank For Agricultural And Rural Development), notwithstanding the presence of RBI. The post-freedom time frame saw double-dealing of rustic poor needing credit, by the hands of moneylenders and merchants. Advances were conceded at exceptionally exorbitant loan fees which at last maneuvered defaulters into an obligation trap, burglarizing them out of credit. To stop this double-dealing NABARD was laid out to give country regions simple credit. Despite the fact that RBI is the public financial pinnacle body, NABARD has been given abilities that lay out it as the zenith banking body in rustic India which directs all the credit and banking exercises of country India. Formal sector credit are essential for India:

Comparison between Formal and Informal CreditThe conventional area actually meets just about a portion of the absolute credit needs of rustic individuals. The excess credit needs are met from casual sources. Most advances from casual loan specialists convey an exceptionally exorbitant financing cost and do barely anything to build the pay of the borrowers.

As of now, the more extravagant families get formal credit while the poor need to rely upon casual sources. It is critical that the proper credit is disseminated all the more similarly so the poor can profit from the less expensive advances. Future scope of formal credit sectorCountless exchanges in our everyday exercises include credit in some structure or the other. Credit (advance) alludes to an arrangement wherein the loan specialist supplies the borrower with cash, labor and products as a trade-off for the guarantee of future installment. Frequently Asked QuestionsWhy is it necessary to supervise the functioning of formal loan sources?

What are the reasons for most poor households being unable to borrow from the formal sector?

Rural households primarily receive formal loans from these sources are?

What are the terms of credit?

In urban areas, describe the pattern of formal and informal credit sources?

|

Reffered: https://www.geeksforgeeks.org

| Class 10 |

Type: | Geek |

Category: | Coding |

Sub Category: | Tutorial |

Uploaded by: | Admin |

Views: | 12 |